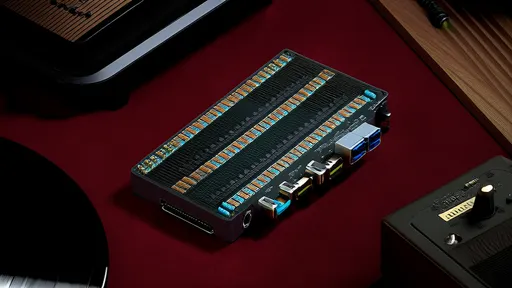

The esports industry has witnessed explosive growth in recent years, with team-branded peripherals becoming a significant revenue stream for organizations and manufacturers alike. As the market for co-branded gaming gear becomes increasingly competitive, developing accurate sales prediction models has emerged as a critical business intelligence tool for stakeholders across the ecosystem.

The rise of team-affiliated hardware has transformed from simple logo placements to sophisticated product collaborations featuring custom color schemes, player-inspired designs, and even performance tweaks endorsed by professional gamers. This evolution has created complex consumer behavior patterns that traditional retail forecasting methods struggle to capture effectively.

Market analysts note that successful prediction models must account for multiple dynamic factors. Team performance metrics, social media engagement levels, and tournament viewership statistics all contribute to the "halo effect" that drives peripheral sales. The 2023 championship season demonstrated this clearly when underdog victories by mid-tier teams resulted in unexpected 300% spikes in their co-branded keyboard and mouse sales.

Manufacturers face particular challenges in inventory planning for these products. Unlike standard gaming gear with relatively stable demand curves, team-branded peripherals experience dramatic fluctuations tied to esports events and viral moments. Overproduction leads to costly discounting, while stockouts mean missed opportunities during peak demand periods.

The most sophisticated prediction frameworks now incorporate machine learning algorithms that process real-time data streams. These systems analyze everything from Twitch chat sentiment to Reddit discussion volumes, creating constantly adjusting sales forecasts. Early adopters of these models have reported 40-60% improvements in forecast accuracy compared to traditional methods.

Regional differences play a significant role in modeling approaches. Asian markets show stronger correlations between live tournament performance and immediate sales bumps, while Western consumers tend to respond more to sustained social media campaigns. The most effective models segment predictions by geography, accounting for these behavioral variations.

Pricing strategy represents another critical variable. Premium-priced limited editions featuring player signatures or special materials follow different demand patterns than mass-market variants. Some organizations have found success with dynamic pricing models that adjust based on real-time demand signals and inventory levels.

The lifecycle of team-branded products introduces additional complexity. Unlike traditional hardware with multi-year relevance, the value proposition of esports peripherals often diminishes when rosters change or teams rebrand. Prediction windows for these products typically focus on 6-12 month horizons rather than the multi-year forecasts common in conventional consumer electronics.

Partnership structures between teams and manufacturers significantly impact model parameters. Revenue-sharing agreements create different forecasting priorities than flat licensing fee arrangements. Some cutting-edge models now include contractual terms as input variables to optimize for various partnership scenarios.

Consumer demographics add another layer of nuance. The esports hardware market spans from hardcore fans collecting full team gear sets to casual gamers making occasional themed purchases. Advanced models create separate projections for these segments, recognizing their distinct purchasing triggers and price sensitivities.

The COVID-19 pandemic unexpectedly provided valuable data points about online sales behavior during cancelled live events. This historical anomaly helped refine models to better account for digital-native purchasing patterns that continue evolving in the post-pandemic landscape.

Emerging technologies like augmented reality try-on features and blockchain-based authentication for collectible items are creating new variables for consideration. Forward-looking models now include adoption rate projections for these technologies and their potential impact on mainstream product sales.

Industry experts emphasize that prediction models must balance quantitative data with qualitative insights. The "cool factor" of particular designs or unexpected celebrity endorsements can dramatically shift demand in ways that pure data analysis might miss. The most successful frameworks incorporate human oversight to account for these creative variables.

As the market matures, we're seeing increased standardization of key performance indicators across the industry. This allows for more accurate benchmarking and comparison shopping data to feed into prediction algorithms. However, proprietary data sources remain a competitive advantage for leading manufacturers and esports organizations.

The next generation of prediction models likely will incorporate more psychological and behavioral economic principles. Understanding the emotional drivers behind esports fandom and hardware purchases could unlock new levels of forecast precision, particularly for limited-edition releases and special collaborations.

With global esports revenues projected to continue their rapid growth, the stakes for accurate sales predictions have never been higher. Organizations that master these modeling techniques gain significant advantages in inventory management, marketing spend allocation, and partnership negotiations. The difference between guessing and knowing could determine which brands thrive in this competitive space.

As the industry evolves, so too must the prediction methodologies. What began as simple spreadsheet projections has grown into complex, AI-driven systems processing dozens of real-time data streams. This technological arms race shows no signs of slowing as the economic potential of esports hardware continues expanding into new markets and product categories.

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025