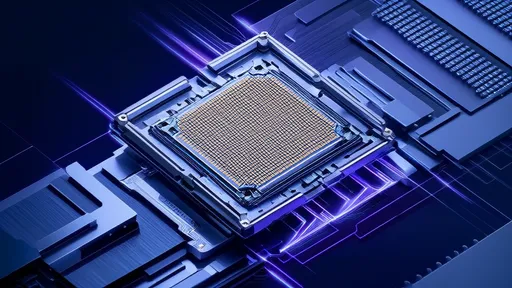

The global semiconductor industry has entered an era of unprecedented transformation as geopolitical tensions and supply chain vulnerabilities force nations to reconsider their reliance on foreign technology. Nowhere is this shift more pronounced than in China's aggressive push for domestic substitution of chip manufacturing equipment - a strategic move that could reshape the entire electronics ecosystem.

The Silent Revolution in Semiconductor Tools

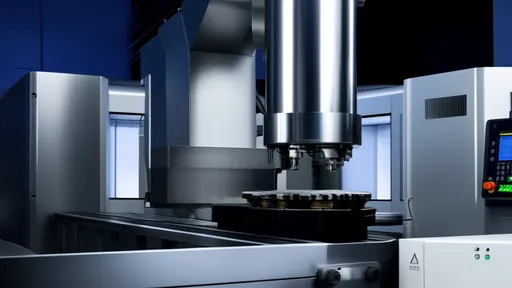

Behind the glittering facade of smartphone launches and AI breakthroughs, a quiet revolution has been brewing in factory floors across China. Domestic equipment manufacturers have been making steady progress in developing homegrown alternatives to the sophisticated machinery traditionally dominated by American, Dutch, and Japanese firms. What began as a trickle of lower-end replacements has gradually evolved into comprehensive solutions covering more advanced nodes.

Industry veterans recall how Chinese fabs would reluctantly use local equipment only for non-critical processes as recently as five years ago. Today, the narrative has changed dramatically. "We're seeing complete production lines where 70-80% of the equipment comes from Chinese suppliers," notes a semiconductor consultant who requested anonymity due to client confidentiality. "The quality gap is narrowing faster than most Western analysts predicted."

From Imitation to Innovation

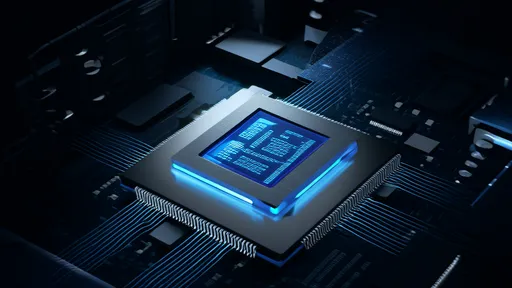

The journey from imitation to genuine innovation has been arduous. Early attempts at reverse-engineering foreign equipment often resulted in machines that could replicate basic functions but lacked the precision and reliability required for mass production. However, sustained investment in R&D and strategic talent acquisition have begun yielding fruit.

Chinese etch equipment makers, for instance, have made significant breakthroughs in plasma control systems - a critical technology where they previously lagged behind Lam Research and Tokyo Electron. Similarly, domestic deposition tool manufacturers have developed novel approaches to thin-film uniformity that challenge Applied Materials' dominance in certain applications.

"What's interesting," observes a tech analyst based in Shanghai, "is that Chinese engineers aren't just copying anymore. They're solving problems differently - sometimes with simpler, more elegant solutions that Western manufacturers overlooked because they were locked into existing architectures."

The Supply Chain Ripple Effect

As domestic equipment gains traction, the ripple effects throughout China's semiconductor supply chain are becoming increasingly visible. Local component suppliers who once struggled to find buyers are now working at full capacity. Specialized ceramics manufacturers, precision motion control specialists, and ultra-high vacuum component producers have all seen demand surge.

This vertical integration creates a self-reinforcing cycle. With more domestic equipment using domestic components, the entire ecosystem becomes more resilient. "It's not just about replacing foreign machines anymore," explains a supply chain manager at a major Chinese fab. "We're building an entirely new infrastructure where specifications, maintenance protocols, and even the training curriculum for technicians are optimized for Chinese equipment."

The Talent Factor

Perhaps the most underappreciated aspect of China's equipment localization drive has been the human capital transformation. Where semiconductor equipment companies once struggled to attract top engineering talent compared to flashier internet giants, they're now drawing some of the brightest minds. Competitive salaries combined with a sense of national mission have changed the career calculus for many young engineers.

Universities have responded by creating specialized programs in semiconductor equipment engineering - a discipline that barely existed as a distinct field in China a decade ago. Industry-academia collaboration has intensified, with equipment makers funding research chairs and establishing joint laboratories. "The knowledge transfer happening now is unprecedented," remarks a professor at Tsinghua University. "We're seeing fundamental research findings move from lab to fab in two or three years instead of the traditional five to seven."

Geopolitical Catalysts

While technological progress would have continued regardless, recent export controls have undoubtedly accelerated the domestic substitution timeline. Each new restriction has paradoxically strengthened the business case for Chinese alternatives. Fab managers who might have preferred foreign equipment for its proven track record now face starker choices - wait indefinitely for uncertain approvals or adapt processes to accommodate domestic tools.

The psychological shift within Chinese semiconductor companies has been profound. "There's no more 'foreign is better' default mentality," says a veteran process engineer who has worked with both imported and local equipment. "Younger engineers especially approach domestic tools without the baggage of preconceptions. They just see engineering problems that need solving."

The Road Ahead

Challenges remain, particularly in the most advanced process nodes where extreme ultraviolet (EUV) lithography and certain inspection technologies still present formidable hurdles. However, the trajectory is clear. Industry projections suggest that within five years, Chinese fabs could source over 50% of their equipment needs domestically for mature nodes, with that percentage rising steadily for more advanced processes.

What began as a supply chain security imperative is evolving into something more profound - the emergence of a parallel semiconductor equipment industry with its own standards, best practices, and innovation pathways. The implications for global competition, technology standards, and even the geography of semiconductor manufacturing could be far-reaching indeed.

As one industry insider put it: "We're not just witnessing equipment substitution. We're seeing the birth of an alternative semiconductor paradigm." Whether this parallel ecosystem will remain largely China-centric or expand its influence globally remains one of the most intriguing questions for the industry's future.

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025